Intel's Q1 2019 Earnings: Expansion, Innovation, and Challenges

Table of Contents

- Introduction

- Intel's Second Quarter 2018 Earnings Recap

- Intel's Focus on Expansion, Innovation, and Execution

- Expanding and Capitalizing on Key Technology Inflections

- Accelerating Innovation Across Various Pillars

- Improving Execution and Focusing on Vital Programs

- Revised Outlook and Expectations for 2019

- Decline in Data-Centric Sales

- Challenges in Memory Pricing and China's Weakness

- Projections for PC-Centric Business

- Gross Margin and Operating Margin Dynamics

- 5G and Intel's Strategic Assessment

- Progress of 10 Nanometer Technology

- Developing Intel's GPUs and Architectures

- Discussion on Memory Business and Partnerships

- Overview of Enterprise and Government Performance

- Outlook on Data Center Group and Common Service Provider Segment

- Strategic Expansion in 5G Network Connectivity

- Progress of Server CPU Competitiveness

- Expectations for Discrete GPUs and GPU Products

- Discussion on Data Center Group's Gross Margin

- Future Trends and Expectations for Gross Margin

- Conclusion

Intel's Second Quarter 2018 Earnings Recap

In the first quarter of 2019, Intel Corporation reported flat total revenue of $16.1 billion. While the PC centric segment grew by 4%, the data centric businesses experienced a decline of 5%. Despite these mixed results, Intel's leadership team remains focused on delivering for their customers and capitalizing on key technology inflections.

Intel's Focus on Expansion, Innovation, and Execution

Intel is undergoing a transformation from being a PC-centric company to becoming a data-centric company. This shift involves expanding their product lineup, accelerating innovation, improving execution, and evolving their culture. The company aims to identify and capitalize on key technology inflections, such as artificial intelligence (AI), 5G, and autonomous driving, to play a larger role in customers' success.

Intel has made significant progress in various areas by intensifying their focus on expansion, innovation, and execution. They have launched their first-ever data-centric portfolio, including the second-generation Xeon scalable processor with built-in AI acceleration. Collaborations with industry leaders, like Siemens, have showcased Intel's AI capabilities and provided real-time diagnosis using DL boost technology.

The company is also gaining traction in the IoT market, with eight new global ADAS designs and the adoption of their REM technology by a major North American automaker. As the 5G market opportunity grows, Intel is winding down its 5G smartphone modem business and focusing on network and edge infrastructure, where they expect to have a strategic advantage.

Revised Outlook and Expectations for 2019

Despite Intel's Record-breaking 2018, their revised expectations for 2019 reflect concerns about underlying market trends. The decline in memory pricing, inventory and capacity digestion in the data center group, and increased China headwinds have led to a more cautious IT spending environment.

As a result, Intel's full-year outlook is now projected to be $69 billion in revenue, a 3% decline year-over-year. Data-centric revenue is expected to decline in the low single digits, with the data center group specifically experiencing a mid-single digit decline due to China weakness and inventory and capacity absorption. The PC centric forecast, however, remains unchanged at low single digits.

Intel forecasts an operating margin of 32%, down approximately 3% year-over-year, and an EPS of $4.35, down 5% year-over-year. Despite these challenges, Intel remains committed to reducing spending and focusing their resources on vital programs.

Gross Margin and Operating Margin Dynamics

Intel's gross margin and operating margin are impacted by various factors, including the cost of their 10 nanometer ramp and NAND pricing weakness. In the first quarter, lower gross margin was primarily due to the cost of 10 nanometer ramp and lower NAND prices. However, Intel expects improvements in the second quarter as volume manufacturing is ramped up and yields improve.

While the gross margin may be lower in the earlier stages of transitioning to a new node, Intel anticipates it will stabilize as they increase production volume and improve yields. Their focus on cost reduction and improved execution will further contribute to margin improvements in the second half of the year.

5G and Intel's Strategic Assessment

Intel's strategic assessment of the 5G market has led them to exit the 5G smartphone modem business and focus on the transformation of the wireless network and edge infrastructure. The company is committed to maintaining its current 4G customer commitments and conducting a strategic assessment of 5G modems for PC and IoT sectors.

While the decision to exit the smartphone modem business reduces spending, Intel remains innovative in the 5G network infrastructure segment. They showcased a range of 5G products at Mobile World Congress, including FPGA acceleration cards and 10 nanometer base snow Ridge Network SOC for 5G base stations. Intel expects to win a significant market share in the base station segment, aiming for 40% market share by 2022.

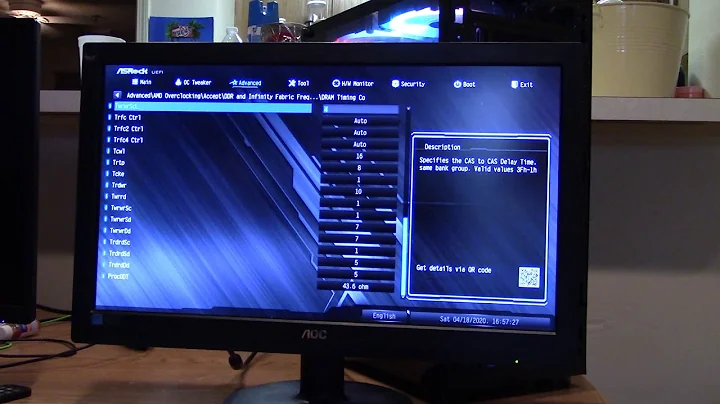

Progress of 10 Nanometer Technology

Intel's progress in developing their 10 nanometer technology has been positive, with improved yields and manufacturing velocity. They expect to qualify their first volume 10 nanometer product, Ice Lake, in the second quarter. This progress contributes to Intel's confidence in 10 nanometer technology and supports their increased goals for 10 nanometer volume.

Developing Intel's GPUs and Architectures

In line with their strategy to capitalize on key technology inflections, Intel is investing in discrete GPUs to expand their product lineup. They have plans to launch a new integrated GPU in the near term and discrete GPUs for clients and data centers in 2020. Intel believes that architectures beyond the CPU, such as GPUs, FPGA, and AI accelerators, are essential for meeting the requirements of AI and Parallel processing workloads.

Discussion on Memory Business and Partnerships

Intel's memory business faced challenges due to ongoing NAND pricing pressures. However, the company recognizes the process technology advantage they have and aims to execute better to improve returns in the NAND business. Intel is open to partnerships that can enhance their memory business and accelerate progress in areas such as network infrastructure.

Overview of Enterprise and Government Performance

Intel experienced a decline in revenue for the enterprise and government segment, primarily due to inventory correction and digestion of cloud service providers. The decline was also influenced by increased competition and China weakness. However, Intel remains confident in the overall demand for enterprise and government solutions, as customer conversations reveal an expected uptick in demand in the second half of the year.

Outlook on Data Center Group and Common Service Provider Segment

Intel expects a modest improvement in the common service provider segment in the second half of the year. However, they anticipate continued digestion and inventory correction in enterprise and government segments, as well as weaker demand in China. While overall data centric sales are projected to decline in the low single digits, the company believes in the long-term growth potential of 5G network connectivity and envisions a significant role for Intel in this segment.

Strategic Expansion in 5G Network Connectivity

Intel views 5G network connectivity as a crucial area for growth and focuses on key technologies that enable high-performance computing, AI, and data-centric workloads. They are confident in their product lineup and partnerships, which position them well for the future. As 5G deployment accelerates globally, Intel aims to play a strategic role in the transformation of network and edge infrastructure.

Progress of Server CPU Competitiveness

Intel continues to invest in server CPUs and is pleased with the launch of their Cascade Lake product, which offers significant performance enhancements and AI acceleration. They are focused on meeting customer demand and improving execution as they ramp up volume production of 10 nanometer server CPUs in alignment with future client launches. Despite increased competition, Intel believes they are positioned competitively in the second half of the year.

Expectations for Discrete GPUs and GPU Products

Intel's investment in discrete GPUs is driven by their belief in the importance of architectures beyond the CPU. They anticipate launching these GPUs in 2020 and expect strong performance given their existing core architecture and deep domain knowledge. Discrete GPUs will enhance Intel's product lineup and allow them to meet the evolving demands of AI and parallel processing workloads.

Discussion on Data Center Group's Gross Margin

Intel's data center group experienced a decline in gross margin due to unit volume declines and the early stages of 10 nanometer product ramp. However, as production volume increases and yields improve, Intel expects to stabilize and improve gross margin. The second half of the year is projected to see margin improvements in line with revenue growth.

Future Trends and Expectations for Gross Margin

While Intel's gross margin experienced challenges in the first quarter, the company expects improvements as they ramp up volume manufacturing and enhance product yields. They remain focused on reducing costs, improving execution, and delivering innovative solutions. Intel aims to achieve consistency in gross margin and expects to see improvement in the second half of the year.

Conclusion

Intel Corporation remains committed to expanding their product lineup, accelerating innovation, and improving execution as they undergo a transformation into a data-centric company. Despite challenges in memory pricing, China weakness, and increased competition, Intel is optimistic about their long-term growth potential in areas such as 5G network connectivity, AI, and autonomous driving. The company's focus on key technology inflections will position them for success in the evolving data-centric era.

10.6K

10.6K

13.52%

13.52%

14

14

43.1K

43.1K

17.49%

17.49%

24

24

< 5K

< 5K

1

1

< 5K

< 5K

25.2%

25.2%

10

10

7.3K

7.3K

47.36%

47.36%

16

16

< 5K

< 5K

13

13

24.9K

24.9K

16.55%

16.55%

66

66

45.7K

45.7K

16.2%

16.2%

45

45

6.3K

6.3K

29.81%

29.81%

3

3

WHY YOU SHOULD CHOOSE TOOLIFY

WHY YOU SHOULD CHOOSE TOOLIFY