US Stock Market Analysis: Potential Risks and Opportunities

Table of Contents:

- Introduction

- Analysis of NASDAQ

- Analysis of S&P 500

- Weekly Chart Analysis

- Yellow Tai Chi Warning Signal

- Cumulative Gains and Losses

- Individual Stock Analysis

- Nvidia

- Tesla

- LLY

- SMCI

- AMD

- Microsoft

- Google

- Apple

- Meta Platforms

- Coinbase

- Other Bitcoin-related Stocks

- Conclusion

Introduction

In this article, we will analyze the recent performance of the US stock market and discuss the potential risks and opportunities that lie ahead. We will focus on the NASDAQ and S&P 500 indices and also delve into the analysis of individual stocks such as Nvidia, Tesla, LLY, SMCI, AMD, Microsoft, Google, Apple, Meta Platforms, Coinbase, and other Bitcoin-related stocks. By understanding the technical indicators and chart patterns, investors can make informed decisions regarding their investment strategies.

Analysis of NASDAQ

Daily Chart Analysis

The recent performance of the NASDAQ index has been marked by a downward movement, with a retest of the previous gap. However, concerns about inflation and delayed interest rate cuts have created uncertainty in the market, leading to a short-term weakness. With the index nearing its historical high and facing upward pressure, investors are questioning whether this is a temporary pullback or the start of a medium or long-term correction. Looking at previous instances, we have observed similar downward gaps followed by an immediate upward movement. However, considering the extended period of gains and the increasing risk due to the accumulation of time, caution is advised.

MACD Indicator Analysis

The MACD indicator on the NASDAQ index has been consistently showing high-level bearish crossovers (death crosses), followed by immediate bullish crossovers (golden crosses). This repetitive pattern indicates a volatile market with uncertain direction. Investors should closely monitor the high-level oscillations and be prepared to respond to the ongoing high volatility.

Time Cycle Patterns

We have previously discussed the time cycle patterns in the US stock market, which include specific months indicating high and low points. As we are approaching March, which historically represents a high point, we anticipate a critical and risky period in the next two to three weeks. A medium-term correction lasting more than three weeks is likely to occur around March. However, it is important to note that such a correction can present opportunities for strategic investments. Additionally, as this year is an election year, the timing of the high and low points in August, October or November, and year-end might slightly vary.

Analysis of S&P 500

Weekly Chart Analysis

The S&P 500 index has seen a remarkable nine-week consecutive rise, indicating a strong upward trend. However, the recent decline formed a bullish harami pattern, where the weekly candle's body was completely within the previous green candle's body. The RSI indicator on the weekly chart indicates overbought conditions, with the RSI value exceeding 72 at the previous high point. Although the weekly candle did not fall below the five-week moving average, the RSI value dropped to 68.8, suggesting overbought risks on the weekly chart. Furthermore, the appearance of a prolonged yellow Tai Chi warning signal on the weekly chart is notable as such signals are rare and carry a low probability. Therefore, investors should pay close attention to the potential risks indicated by the weekly chart, especially if the closing price falls below the lowest point of the yellow Tai Chi warning signal.

Cumulative Gains and Losses

The recent performance of major tech stocks indicates a downturn in high-level stocks. While the indices, such as Google, Amazon, Microsoft, and Nvidia, have shown signs of weakness, Nvidia has managed to maintain a marginal increase of 0.67% among major tech stocks. Tesla, on the other HAND, has experienced a slight increase of 3.3%, but it is important to note that it reached an extreme oversold position prior to this increase. Another notable stock is LLY, which has continued to rise steadily with a cumulative increase of 5.66%. However, it is essential to monitor the overall market trend, as the performance of these stocks can be influenced by other factors.

Individual Stock Analysis

Nvidia

Nvidia is currently facing significant attention as investors are closely watching its upcoming earnings report on Wednesday. The stock has reached a critical point on the daily chart, where the yellow Tai Chi signal has appeared multiple times. Although the lowest price of the yellow Tai Chi has not been breached, the stock has reached an unsustainable high position and has shown signs of weakness. The immediate gap filling observed after the strong gap on the third candle is an indication of a lack of buying pressure. Given these circumstances, the earnings report could drastically affect the stock's movement, and investors should be prepared for significant volatility.

Tesla

Tesla has recently shown a bullish reversal pattern with the RSI indicator signaling a bottom divergence. The stock experienced a downward gap followed by a bullish candle, indicating a potential rebound. It continued to rise and challenge the upper limit of the gap during Friday's session. The resistance level at the upper boundary of the gap is $206.77, while the next downward gap resistance stands at $225. Investors should closely monitor the stock's behavior around these price levels, as they serve as critical indicators for its future movement.

LLY

LLY has displayed consistent strength with a cumulative increase of 5.66%. Its steady and stable performance makes it an attractive stock. However, investors should keep track of the potential impact of overall market conditions and sector trends on LLY's future performance.

SMCI

SMCI, a stock related to the chip industry, experienced a significant decline, indicating a potential sell-off. The stock's high-volume drop at the beginning of Friday's session and subsequent downward movement is a concerning signal. Given the stock's substantial increase in recent times, the high-volume drop and the engulfing bearish candle suggest potential downward movement. Investors should exercise caution and consider reducing their positions.

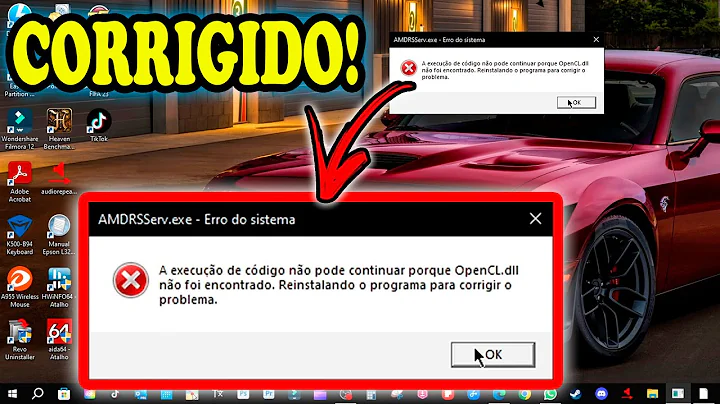

AMD

AMD is currently showing a weak trend, unable to establish new highs despite being in a potential upward structure. The stock's sideways movement and inability to break new highs indicate increasing risk. Additionally, the Six Gurus indicator is gradually diminishing, affirming the higher risk associated with this trend. In the event of an escalated market risk next week or if Nvidia's performance negatively impacts the entire AI chip sector, there could be further downside to the stock. The weekly chart for AMD also reveals a cautionary picture, with a potential bearish price reversal pattern following the completion of an upward structure 9.

Microsoft

Microsoft has failed to display significant recovery strength after the downward gap. The stock's structure is indicating weakness, with the failure to fill the gap and the appearance of a death cross on the MACD indicator. Investors should exercise caution, as the strong downward gap in Microsoft has been confirmed and may influence the overall index.

Google

Google's performance has been relatively weak, with an attempt to fill the gap of poor earnings falling short. The recent gaps, which were immediately filled, suggest weakness. The stock is currently within the descending structure 4 and is nearing the 60-day moving average, an important support level. Considering the conditions following Microsoft's upward structure 9 and the subsequent gap filling after a prolonged period, Google's strength appears limited. Therefore, investors should be cautious as the stock approaches the $180 support level, which has been tested multiple times.

Apple

Apple has been exhibiting significant weakness, struggling to break out of its consolidation range. The repetition of testing the lower support trendline reflects a bearish descending triangle pattern. The fourth test of this pattern could break the support level, marking a bearish signal. It is essential to pay close attention to the $180 support level as a breach could lead to significant consequences. Investors should be cautious in the coming weeks as this level will be crucial for Apple's performance.

Meta Platforms

Meta Platforms, previously known as Facebook, has shown relative strength compared to other large technology stocks. Currently, it is in an upward structure 3, remaining above the five-day moving average. Although it has not completely filled the previous bullish gaps, caution should be exercised due to the consecutive high-level topping red bars in the Six Gurus indicator. Nonetheless, the overall strength of Meta Platforms presents a positive outlook.

Coinbase

Coinbase, the leading stock in the Bitcoin sector, has witnessed an extreme rise with five strong gaps before the completion of structure 9. It is important to note that the Second, sixth, and seventh gaps were all false bearish gaps turned bullish. These gaps have proven to be strong, and if the stock sustains structure 8 and 9 in the upcoming week, we may witness a significant surge in its value. However, caution is advised as the stock carries a high level of speculation, indicated by the astonishing turnover rate of 13%. The consecutive high-level red bars in the Six Gurus indicator also hint at the possibility of profit-taking and unwinding of positions.

Other Bitcoin-related Stocks

Other Bitcoin-related stocks have exhibited slightly weaker performance compared to Coinbase. Bitcoin-related stocks experienced downward gaps that were immediately filled, indicating weakness. Additionally, a bearish harami pattern and a break below the five-day moving average were observed on Friday's session. With a high turnover rate of 43% and a location near the previous high, caution is advised. The continuous increase in the Six Gurus indicator further strengthens the importance of being vigilant.

Conclusion

In conclusion, the US stock market has experienced a recent decline after a prolonged period of growth. The NASDAQ and S&P 500 indices have shown signs of weakness, indicating the potential for a medium-term correction. Individual stocks such as Nvidia, Tesla, LLY, SMCI, AMD, Microsoft, Google, Apple, Meta Platforms, Coinbase, and other Bitcoin-related stocks require careful analysis to navigate the market uncertainties. By closely monitoring technical indicators, chart patterns, and market conditions, investors can make informed decisions to maximize their investment returns.

Disclaimer: This article is for informational purposes only and should not be considered as financial advice. Investors should conduct their own research and analysis before making any investment decisions.

Resources:

WHY YOU SHOULD CHOOSE TOOLIFY

WHY YOU SHOULD CHOOSE TOOLIFY